With oil and gas activities growing like gangbusters, process automation and instrumentation companies are understandably calling a lot of attention to those activities, emphasizing their capabilities in a burgeoning industry. But at so many of the latest user group meetings that have filled my fall travel schedule, there’s also been an increasing amount of talk about oil producers struggling with exploration costs and falling prices in a competitive market.

Automation execs point to concerns about mega projects becoming perhaps a little too prevalent. At Emerson Exchange last month in Orlando, Fla., Steve Sonnenberg, president of Emerson Process Management, talked about how today’s projects are getting bigger and more complex than every before. “In the oil and gas industry, the number of projects over a billion dollars has quadrupled in the last 10 years,” he said.

But can that be sustained? At the Yokogawa Users Conference a couple months ago in Houston, Chet Mroz, president and CEO of Yokogawa America, mentioned that Chevron was cutting way back on it capital expenditure. The major oil producer just had too many mega projects going on all at once and realized they needed to scale back. Chevron announced last month that it was delaying the development of the second phase of a deepwater natural gas project off Indonesia. Yokogawa certainly feels the effects of such cutbacks.

At the same time, conversations about falling gas prices often lead to the reasons why exploration companies need to pursue automation all the more—to improve efficiencies and get the most out of the drilling operations. At GE Intelligent Platforms’ User Summit just last week in Orlando, I spoke with an engineer from one of the largest onshore drilling companies who was very excited at the prospects of applying what he’d learned to his operation’s shale efforts.

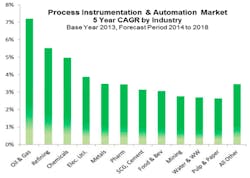

Whatever the anecdotal evidence is, Global Automation Research contends that its predicted five-year growth rate for process instrumentation and automation in oil and gas will not decline, despite a drop in crude oil prices from a high of $113 in June to about $85 in October. “We were naturally concerned that a price-related cutback in oil production spending would impact our forecast,” said Paul Rasmusson, president of Global Automation Research, in a report, noting that was not the case.

Oil prices have been dropping because of an oversupply caused not only by a worldwide drop in demand but also increased production from U.S. shale and also in Libya and Iraq. Saudi Arabia also plans to maintain its production rather than push prices back up with OPEC’s usual tactics of reducing production.

According to the International Energy Agency, only a small portion of U.S. oil production will be affected by the lower prices. Most U.S. shale production costs range from $65 to $75, letting them maintain moderate growth with the selling price at $85. There is more risk for oil sands production in Canada, where the breakeven price is $100.

Global Automation Research expects oil industry spending on process instrumentation and automation to continue at its current rate through the end of this year and into the next. “Oil companies will finish projects near completion, continue drilling and production activities to maintain trained crews, and press suppliers for efficiency improvements,” the report said.

However, continued low oil prices would likely mean a drop in industry spending, the report continued. “Both Shell and ConocoPhillips have said that lower oil prices will drive the 2015 capital expenditures lower,” the authors said. “Honeywell, GE and Emerson have all indicated that they expect near-term oil industry spending to remain constant, but extended low oil prices will affect 2015 O&G revenues.”

The recovery of European, Chinese and Indian economies over the five-year forecast period would drive oil demand to levels that support higher oil prices, leading to the recovery of automation spending.

Leaders relevant to this article: