We’ve all heard it for so long now that it’s practically become common knowledge—low-skilled, non-complex, low-cost manufacturing will no longer happen in the U.S.; instead it will take place in countries where labor costs are and will remain low in comparison to the U.S.

Even the results to our own survey on the U.S. manufacturing renaissance (based on responses from readers in the manufacturing industries) indicate that the type of manufacturing now flourishing in the U.S. is of the more advanced variety. Another study, however, indicates that the winds of change may be starting to blow against this long-held view.

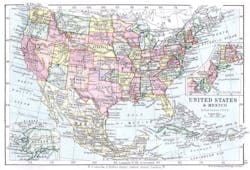

Entrada Group, a company that assists manufacturers in establishing operations in Mexico, conducted a study of manufacturers’ opinions, priorities and experiences with respect to low-cost manufacturing locations globally. Though Entrada Group’s biases are clear based on their business model, the results of their survey remain interesting.

Their survey was conducted between late 2013 and early 2014. Of the companies surveyed, 73 percent are based in the United States, 14 percent in Canada, and 8 percent in Europe. Respondents were predominantly (62 percent) C-level executives based largely (82 percent) at privately held companies with most (69 percent) having fewer than 500 employees.

Principal findings of the study show that:

- The United States is the most attractive low-cost manufacturing location worldwide, with Mexico being the next most attractive.

- Manufacturing expansion is widespread, with most respondents currently planning to expand operations—67 percent of companies that already produce in two or more locations plan expansion to an additional location. Thirty-three percent of companies that manufacture solely at their headquarters location plan to open an additional manufacturing location.

- Quality is important to companies when selecting manufacturing sites, but it remains locked in a battle for supremacy with low-costs. Regardless of company size, respondents indicated high-quality production remains essential. But as Entrada notes in its study, “admitting to lower quality standards would be very surprising.” Tellingly, respondents also indicated in the survey that achieving low operating costs tops high-quality production standards by a nearly two-to-one margin. In addition, 69 percent of respondents said that a low-cost manufacturing strategy is “very important” or “important” to future growth.

- Though many companies have previously invested significant time and money establishing operations in a low-cost location, they didn’t always realize the cost savings they sought, according to Entrada. Regardless of the low-cost location selected, half of Entrada’s survey respondents reported realizing “only moderate savings.” The reason for this is that cost savings realized due to affordable local labor in China were offset by the fluctuating currency, increasing freight charges and compensation for inconsistent product quality, not to mention uneven treatment of intellectual property.

Leaders relevant to this article: