In increasing efforts to find and get at the world’s remaining resources, the oil and gas industry is going further afield—further out to sea, in deeper waters, to more remote areas, under deeper layers of ice, etc. But energy companies are also getting smarter about oil exploration and production (E&P).

Advancing automation systems and increasing use of smart sensors are giving rise to the “smart field,” an industry that will tap an additional 125 Bbbl of oil by 2015 and be worth more than $33 billion by 2022, according to The Energy Exchange, organizers of the inaugural Smart Fields Summit taking place this week in Houston.

“The advancement of this technology included multiple systems such as smart sensors, automated actuators, use of multi-phase flow meters, and many others,” said Ayman Al-Issa, digital oil fields cybersecurity advisor for ADMA-OPCO, in an interview with conference organizers. “Smart fields give companies more vision about their production operations and provide them with valuable real-time data. Smart fields should help companies to increase oil production from fields, improve safety and security, and reduce cost.”

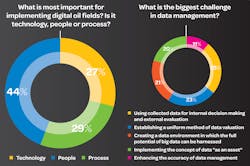

Making better use of that real-time data, however, is a key concern among respondents of a survey conducted by The Energy Exchange, key among them E&P companies and service providers. Almost all respondents (90 percent) identified data management as a challenge, pointing specifically to concerns about how to use the data collected for internal decision-making and external evaluation (25 percent), how to establish a uniform method of data valuation (23 percent), and how to create an environment to harness the full potential of big data (21 percent).

For 23 percent of the survey respondents, finding success with smart fields is about increasing the recovery of oil and gas resources. “The oil companies are looking for something new to optimize their production, lower total cost of ownership (TCO), and produce good-quality crude and gas for higher returns,” said Mostafa Al-Kaouri, global research and technology systems analyst for Kuwait Oil Company. “In order to apply this, they need historical and high-frequency digital field data, also people to monitor, analyze and advise, and a collaboration center to communicate and make decisions for production optimization and well/facilities surveillance.”

An almost equal number of respondents (22 percent) look to smart fields as a way to improve health, safety and environment (HSE) performance and decrease the number of accidents. Also important, respondents said, were ensuring data integrity, and accelerating production and lowering costs.

In an open-ended survey question, respondents listed several key priorities for smart field development in the coming year, including safer drilling, equipment reliability, production optimization, wireless tools, staff training, and a slew of issues related to data acquisition and analysis.

Beyond technologies and processes, though, it was the people that respondents saw as the most vital factor in successful smart field development. Some 44 percent said they needed people able to adapt to the new technology and fulfill changed roles. This compares with 29 percent viewing the process as most important, and 27 percent for the technology.

The Smart Fields Summit will focus on a wide range of the concerns brought out in the survey:

- Managing big data effectively

- Optimizing data management

- Improving data security

- New models of smart field development

- Standards for smart fields

- Change management challenges

- Technology for efficient development of smart fields