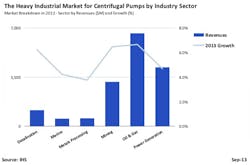

Such heavy industrial sectors as oil and gas, mining, and power generation account for almost half of the world’s pump market revenues (more than 47 percent in 2012, in fact) so it’s not surprise that any amount of uncertainty or volatility in those sectors can have significant impact on pump outlooks. The dichotomy of the oil and gas sector vs. mining, for example, paints a vivid picture.

Together, oil and gas and mining accounted for more than 28 percent of pump revenues last year, according to IHS. Separately, however, the two markets show very different promises for the future, driven by technological advancements, modernization and, conversely, political stirrings. “Both pump manufacturers and their motor and drive suppliers need to be aware of the impending developments in these industries as well as the challenges and opportunities that will ensue,” says Preston Reine, analyst, pumps and fans, for IHS.

The oil and gas sector was the largest industry for pump suppliers last year, accounting for more than 19 percent of market revenues, according to Reine. This sector also represents one of the best opportunities for future pump market growth. “Though historically a conservative industry, this sector has begun to embrace newer technologies in order to accommodate global record-high exploration and production activity,” Reine says. “These technological advancements are clearly evident in the form of speed and flow controls used in pumping systems.”

Because of high crude oil prices and ongoing project spending, pumps sold into upstream applications are expected to grow at a compound annual growth rate (CAGR) of just under 8 percent from 2012 to 2017. Upstream applications rely predominantly on centrifugal pumps, but demand is increasing for positive displacement pumps, Reine points out. “The building momentum of the shale gas revolution and fast-growing demand from offshore projects in Canada, Brazil, Mexico and Venezuela, where the oil drilled is much more viscous than in the United States, require usage of more positive displacement pumps,” he says. “With these regions’ rapid growth, pump suppliers that aim to increase their presence would be wise to broaden their product offerings to accommodate these trends.”

ITT, a technology provider in oil and gas and other industrial markets, showed its understanding of the need to address changes with its recent acquisition of the fast-growing positive displacement pump provider Bornemann Pumps. “Our acquisition of Bornemann Pumps and its leading-edge technologies will further position ITT as a leader within the global oil and gas industry,” said Denise Ramos, ITT’s CEO and president, at the time of the acquisition late last year.

Including midstream and downstream applications, IHS expects revenues for pumps sold into the global oil and gas sector to grow at a CAGR of 7 percent from 2012 to 2017. “Outside of the Americas, Russian refineries are modernizing, Middle Eastern pipeline projects are expected to come to fruition in 2014 and 2015 after slight delays in 2012, and China continues to develop its infrastructure to support its increasing oil and gas operations,” Reine says.

Projects in both the mining and the oil and gas industries are beginning to use pumps that can operate in more abrasive environments. The pressing need for more durable pumps that can operate at different capacities has served as a boon to pump suppliers, yielding higher average selling prices that these manufacturers will continue to benefit from in the future.

However, that makes for brighter prospects in oil and gas than it does in mining, where an industry faced with uncertainty is expected to see a CAGR of about 5 percent from 2012 to 2015. “There has been a gloomy cloud hovering over the mining industry since late 2012, when capital expenditures dropped substantially and several key projects in Africa, Australia and South America were either delayed or cancelled,” Reine says. “The good news is that the first half of 2013 has not been as harsh on pump suppliers as many had feared. While hard times are certainly underway, capital expenditures were large enough to carry over into 2013. Unfortunately, this means that pump suppliers’ worries about the mining industry will likely play out in the second half of 2013 and in 2014. Pump suppliers are poised to endure trying times in this market segment during this period.”

Pump sales into the mining sector are expected to grow less than 4 percent in 2014. Labor unrest affecting miners around the world does not appear to be subsiding, Reine adds. “This could further hinder growth, as worker strikes and other disputes hurt production. Pump manufacturers should be able to raise average selling prices as the need for pumps in more abrasive environments rises, but the lack of projects more than overshadows that slight bright spot.” A low point for mining capex is expected to hit in mid-2014, after which a rebound could occur.

Despite the volatility in these different sectors, the overall growth prospects of these markets are good. Revenues of pumps sold into the heavy industries are forecast to grow at a CAGR of 6.6 percent from 2012 to 2017. “Despite a grim forecast for 2014, increased confidence and investment levels are predicted to spark a rebound for these markets in the middle of 2015 through 2017,” Reine says.

Leaders relevant to this article: