While these areas are seeing a gradual adoption of advanced technology, they are key links in the production chain that must be integrated to realize higher levels of automation, according to a new report by PMMI Business Intelligence.

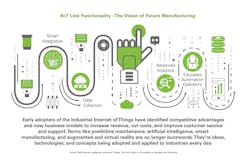

Automation is typically envisioned as robots or sensors on a machine, but automation strategies now extend beyond individual machines to encompass entire operations, and the key to linking an entire operation together is a comprehensive IIoT strategy.

Individual machines within an operation need to be prepared and designed to easily link up with a larger IIoT network, in order to implement a viable 4.0 strategy. IIoT integration and data acquisition are the keystones to expanding automation, enabling the deployment of many other advanced automation strategies.

See it Live at PACK EXPO Connects Nov. 9-13: Are you ready for the new normal? Ensure your equipment is reliable as you implement safety regulations, by FoxJet, An ITW Company. Preview the Showroom Here.

Currently, there is significant opportunity to expand IIoT and integration-ready machines at manufacturers – most of whom have identified only a small portion of their plant floor operations as fully IIoT enabled. But in the next five years, on average, 75% of machines at leading CPGs will be capable of collecting critical machine performance data.

In 2017, manufacturers estimated that only 15% of their lines were IIoT ready. While this number rose to 30% for leading CPGs and 24% for SMEs (small-to-medium sized enterprises) in 2020, there is still a significant gap to be met when it comes to IIoT capability. On average any given manufacturing operation will have 73% of its lines that are not fully connected and integrated.Said one Engineering Manager at a large canned goods facility, “Only half of our lines are collecting data now; all new equipment must have the capability to collect data, it’s part of our capital plan as we upgrade or replace legacy equipment.” What does this mean for OEMs and suppliers? An opportunity to assist manufacturers in expanding their IIoT connectivity outside traditional production processes.

See: Reverse Engineering the Organization

See: The Benefits of Virtual Troubleshooting

What do companies who were interviewed for this report have to say about their automation integration needs and plans?

LEADING CPGS CONTINUE ON THEIR INTEGRATION TIMELINE

“We have 10 lines that are about 70% automated but not yet integrated; we still have some areas in both primary packaging and secondary packaging that need to be automated and we’re considering robotics for case packing and palletizing.” — Chief Engineer, Snack Food Leader

“All of our lines are fully automated, but not all are fully integrated yet; we are progressing with 2 to 3 lines per year.” — Principle Engineer, Beverage Leader

“We are moving toward more automation but have not yet fully integrated our lines.” — Continuous Improvement Manager, Leader in Frozen Foods

“We are adding more automation and robotics in general across our lines and incorporating magnetic motion control; however, none of our lines have the capability to be 4.0 ready - it will be implemented into our manufacturing lines in the future.” — Sr. Director, Packaging, Personal Care Leader

See it Live at PACK EXPO Connects Nov. 9-13: Introducing the EH-84 Best-in-class half-gallon gable top packaging machine, by Evergreen Packaging, LLC. Preview the Showroom Here.

LEGACY LINES STILL CREATE A ROADBLOCK

“Seventy percent of our lines are fully IIoT functional. We still have some old filling lines with low volume that might be considered for future upgrade.” — Product Engineer, Leader in Pharma/ Supplements

4.0 / IIoT IS NOT EVERY COMPANY’S STRATEGY

“Our plants are decentralized globally across very diverse markets and all lines are nearly fully automated, but our strategy does not move us toward a smart 4.0 model.” — Packaging and Processing Engineer, CPG Leader

To access this FREE report and learn more about automation in operations, download below.

Source: PMMI Business Intelligence, “Automation Timeline: The Drive Toward 4.0 Connectivity in Packaging and Processing”