Automation Use Expected to Surge with Reshoring and Legislative Support

U.S. manufacturing reshoring initiatives gained steam several years ago as overseas shipping and labor costs began to eat into the healthy margins once commonly associated with offshore manufacturing. Even in the face of such negative financial impacts, however, reshoring efforts were limited and evidence did not indicate widespread reshoring actions.

Then came COVID-19 and the realization that about half of the world’s disposable masks were produced in China. For many, this proved to be a broad-based and easily understood reason for reducing offshore manufacturing operations. On top of that are the ongoing supply chain impacts caused by overseas manufacturing slowdowns, shipping delays, and issues with unloading goods at ports due to COVID and other, often associated, effects.

Amid these supply chain disruptions, we’re beginning to see more solid evidence of reshoring plans that will likely increase even further with the recent passage of the CHIPS and Science Act.

Automation and robotics research

ABB recently conducted a study based on responses from 1,610 executives in the U.S. and Europe regarding their planned use of various automation technologies and robotics. Their study revealed that 70% of U.S. businesses are planning changes in their operations, with 37% planning to bring production back home and 33% looking to nearshore and shift their operations to a closer location.

According to the ABB study, American companies are relying more on automation to solve supply chain issues, with 43% of respondents saying they are expanding their use of robotics and automation specifically to address supply chain and customer demand issues.

In its report, ABB noted that automation and robotics technologies, which have long been associated with use in the automotive industry, have now significantly expanded across multiple industries, including logistics, food and beverage, retail, and healthcare.

Robotics use spreads

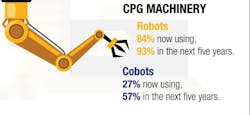

Research by PMMI, Automation World’s parent organization, backs up ABB’s assertion about the spread of robotics beyond the automotive industry, with data showing 84% of consumer-packaged goods companies now use robots somewhere on their production lines. PMMI says this number is expected to rise to 93% in the next five years. Respondents to the PMMI research say improvements in robot functionality, such as vision, self-learning, and artificial intelligence are spurring manufacturers to purchase and use more robots in processing and packaging applications.

According to the International Federation of Robotics, the increase in robot density per 10,000 workers in North America, jumped 28% in Q1 2022 compared to first quarter of 2021, the highest rate of growth recorded by the federation.

This trend is not isolated to the U.S. ABB reports a greater near-term demand for robotics in Europe, where 74% of European businesses indicate they will invest in robotics and automation in the next three years, compared to 62% in the U.S.

Legislative support

With the CHIPS and Science Act now signed into law by President Joe Biden, the U.S. is expected to see significant reshoring efforts around semiconductor manufacturing considering the $39 billion slated to be spent on expanding this industry domestically over the next five years. A new 25% tax credit for companies investing in semiconductor manufacturing equipment or the construction of manufacturing facilities is also included in the legislation.

According to The White House, “Spurred by the passage of the CHIPS and Science Act of 2022, companies have announced nearly $50 billion in additional investments in American semiconductor manufacturing.”

Two examples cited by The White House include:

- Micron is announcing a $40 billion investment in memory chip manufacturing, which will create up to 40,000 new jobs in construction and manufacturing. “This investment alone will bring the U.S. market share of memory chip production from less than 2% to up to 10% over the next decade,” says The White House.

- Qualcomm and GlobalFoundries are announcing a new partnership that includes $4.2 billion to manufacture chips in an expansion of GlobalFoundries’ upstate New York facility. Qualcomm has announced plans to increase semiconductor production in the U.S. by up to 50% over the next five years.

A few weeks after passage of the CHIPS and Science Act, First Solar announced plans to spend “as much as $1.2 billion to boost manufacturing capacity” in the U.S. by around 75%, according to The Wall Street Journal. In its article on First Solar’s decision, The Wall Street Journal reported: “First Solar Chief Executive Mark Widmar had said until recently that although the company was eager to boost its manufacturing footprint, high costs and a lack of policy support meant it was considering adding capacity in Europe or India rather than at home [in the U.S.]. With the new investments, First Solar now expects to have around 10.6 gigawatts of panel-making capacity in the U.S. by 2025—up from an expected 6 gigawatts next year.”

Leaders relevant to this article: