IoT Survey Reveals Motivations, Expectations, Potential Inhibitors

Will the Industrial Internet of Things (IoT) emerge as the next big revolution in manufacturing? Information from IoT-connected devices promises to lower costs, optimize processes, and provide a platform for business innovation; but concerns about security and standardization could stand in its way.

ARC Advisory Group, in conjunction with Automation World, conducted a short web survey in Q2 2014 to gauge the manufacturing industry’s perspective on this current hot topic. Over 200 respondents participated, including current and potential end users, system integrators, OEMs and technology providers. Respondents were drawn from numerous manufacturing industries led by machinery manufacturers and food and beverage companies, which encompass numerous process and packaging machine types. A number of respondents serving continuous process industries also participated, reflecting the widespread interest and numerous potential applications for this technology.

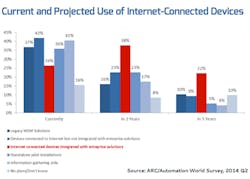

Among other objectives, the survey aimed to provide insight into current and projected use of Internet-connected devices, level of enterprise integration for connected devices, and potential drivers and inhibitors impacting IoT adoption. Most questions asked respondents to indicate what was currently employed vs. what they planned to deploy in two to five years.

While any web survey is subject to the particulars of respondent self-selection (the phenomenon in which people tend to answer questions on topics that interest them), these results clearly indicate that manufacturers are seriously looking at the IoT and what it can do for them. The results also reflect an anticipated migration from the initial benefits of remote monitoring and predictive maintenance in reducing machine downtime, to potential business innovations in areas such as product as a service.

With most of the technological components of the Industrial IoT already available, security concerns remain the most prominent potential obstacles to IoT adoption. Determining actual business value and lack of executive support were other potential inhibitors expressed by survey respondents. These last two items imply the need for greater education into the value of the IoT for those who might benefit.

ARC Advisory Group defines Industrial IoT as connecting intelligent physical entities, such as sensors, devices, machines, assets and products, to each other, to Internet services, and to applications. The industrial IoT architecture builds upon current and emerging technologies such as mobile and intelligent devices, wired and wireless networks, Cloud computing, Big Data, analytics and visualization tools.

Industrial companies are in a unique position in the age of the Internet of Things. Unlike in other IoT segments, such as consumer or Smart Grid, industrial manufacturers are likely to both consume connected products for use in their own operations and produce connected products for use by their end customers. Automotive manufacturers, for example, are racing to add incremental value-add through in-car connectivity and associated applications, but will also need to plan for the use of a new breed of connected machinery in their production facilities.

The unique demands of this potential for dual use makes it vitally important that the entire organization (up to and including the C suite) understands the value proposition inherent in intelligent management of connected products.

Business drivers fueling adoption

Industrial firms have long pursued horizontal and vertical connectivity in their ongoing efforts to improve performance and achieve operational excellence. Reduced machine downtime, particularly unplanned downtime, is a primary initial driver behind anticipated Industrial IoT adoption. Ability to improve this metric provides real business value that can help industrial organizations justify adoption of the IoT and connected devices.

The survey results reflect these drivers, with over 60 percent of respondents citing reduced machine or as- set downtime as a primary driver for considering an IoT solution. Use of IoT-based solutions to improve over- all asset utilization, improve process performance and personnel productivity, and achieve more rapid service response were also high on the list. Some responses reflected a more global view, forecasting that the IoT would have impact across entire operations.

From a timeline perspective, it is interesting to note that reduced downtime and improved service response times were most often cited as current drivers, with improvements in process and personnel productivity as more mid-term motivations. Similarly, the opportunity for business innovation as a potential IoT driver tended to fall more in the two to five year time- frame. This is a higher-order driver, but with anticipated benefit being further out, and one that was not frequently cited as a primary justification for initially adopting the IoT.

Ability to offer or consume new services is one of the potential incremental benefits associated with industrial IoT adoption. A number of suppliers already offer remote diagnostic capabilities, but in many instances these operate off-line, often as a batch processing operation connected via point-to-point interfaces. In our survey group, which included suppliers and other providers as well as end users, close to half currently employ remote diagnostic services.

Of greater interest as far as IoT adoption is concerned are the numerous responses, even in the two- year time frame, where higher-level service offerings are anticipated. These include predictive maintenance services, which are directly tied to reduced asset downtime, as well as adding incremental remote service offerings that leverage the IoT infrastructure. The survey results indicate that both suppliers and users envision a time in the near future when more and more updates, maintenance services, and process improvement tools will be delivered and/or executed remotely.

Another interesting finding is that, although ability to offer products as a service ranked in the lower tier of general business factors driving IoT adoption, it ranked much higher in terms of potential new services enabled by the technology. In the industrial world, this typically translates to selling the service provided by given equipment on a subscription basis rather than simply selling the equipment itself. One of the more prominent examples of this in recent industry IoT discussions are GE’s (GE, http://www.ge.com/) comments that the IoT could enable the company to bill airlines on the basis of thrust delivered vs. just selling jet engines.

Potential inhibitors to adoption

Most people who follow manufacturing technology know that concerns about the security integrity of the industrial IoT and connected devices pose the greatest threat to widespread adoption. This was also clear from the survey results, with close to 60 percent of respondents citing security concerns as a primary impediment to IoT adoption.

Manufacturer concerns about IoT security frequently stem from the universal connectivity inherent in the IoT, reliance on Internet technology (including Cloud platforms and commercial networks), and concerns about publicized breaches of Internet-based solutions. Security issues further threaten to undermine the primary value proposition of reduced unplanned downtime, particularly when minimizing process disruptions is the objective.

Most industrial practitioners are very much aware of the need to cost justify new initiatives, and the survey responses reflected this. A large number of respondents cited potential inhibitors such as unclear financial benefit and budget constraints, but similar responses in areas such as “Organization doesn’t recognize business value” or “No or limited executive support” indicate the need for further market education.

While device connectivity is inherent in the term “Industrial Internet of Things,” the ability to integrate data from connected devices and provide performance-enhancing feedback is integral to its primary value proposition. This is true whether the pursuit is focused on reduced machine downtime, improved productivity, or faster service response, all of which were reported as primary business drivers behind prospective IoT adoption.

Responses to our survey reflect this migration from simple connectivity to true Internet-based integration with enterprise solutions. Numerous respondents reported current use of either legacy M2M solutions, which are typically point-to-point, or use of connected devices that are not integrated with enterprise solutions. Forecast responses, however, indicated definitive intent to migrate toward the use of Internet-connected devices integrated with enterprise solutions.

Integration of enterprise software components, particularly Big Data, Cloud computing and analytics, is a core component of the IoT vision. This capability represents a step change from traditional point-to-point connectivity of industrial devices and helps distinguish the IoT from legacy remote monitoring solutions.

Respondents’ intention to integrate connected devices with these enterprise software components was evident in the survey results. Use of analytics software with future IoT solutions was one of the most distinct changes anticipated as far as what components will be employed in future IoT solutions. This is consistent with the industry’s vision of analytics’ role in the IoT, one that relies on integrated analytics capabilities to achieve incremental performance gains.

Current and anticipated applications

Survey responses indicated a migration over the next two years from remote monitoring and telemetry implementations to more remote asset management and remote service applications. Respondents were more reticent regarding prospects for five years out, however, most likely reflecting justification of initial IoT solutions on the basis of these remote maintenance and remote service applications and not the farther-out potential of initiatives like product as a service.

Another interesting finding regarding anticipated applications relates to potential use of IoT solutions in security applications. Roughly one-quarter of respondents indicated plans to deploy IoT in security applications, which runs counter to the almost 60 percent citing security as a potential inhibitor to adoption.

The results of this survey are revealing in that they show that users, suppliers, OEMs and system integrators are looking at the IoT to solve concrete business problems now, and provide incremental business opportunities in the future. The results also show a need for further education and analysis to achieve the business justifications and sound value propositions necessary to win executive buy-in and customer adoption. Industrial organizations need to assemble sound arguments for both internal and external presentation in order to prepare for IoT adoption and achieve competitive advantage via first-mover positioning.

Evaluation of these survey results shows a clear path to that end. Many installations start with remote maintenance or service management applications, which then expand to predictive maintenance and other higher-level service offerings. One concrete example lies in how the ability to offer products as a service was not evidenced as a primary driver, but it is obvious from other responses that product manufacturers are looking as this possibility as a logical ultimate outcome of IoT infrastructure development.

This survey was conducted by ARC Advisory Group, in conjunction with Automation World magazine, as part of Industrial Internet of Things (IoT) Advisory Service. Polsonetti also maintains a LinkedIn group cover- ing the Industrial Internet of Things that is open to all. Further information is available at www.arcweb.com.