Digital transformation was at the top of the manufacturing agenda this year, as companies continued implementations of advanced technologies such as artificial intelligence (AI), analytics, and connected sensors as part of Industry 4.0 and Industrial Internet of Things (IIoT) initiatives. We wanted to take a closer look at global manufacturers’ own perceptions of their digital maturity—whether they differed between the U.S. and rest of the world—and whether or not executives and the plant floor were seeing things differently.

Toward that end, in July 2019, Automation World fielded a worldwide survey of 277 managers (34%) and operations professionals (45%) across a mix of industries. We also checked in with technology providers to see if our survey findings were in accord with what they were hearing from the market.

Nearly one-third (32%) reported their organization had “clearly stated objectives of technology modernization related to IIoT or Industry 4.0.” Another 48% either had started updating technology without specific corporate goals or were developing plans for modernization. Only 20% of respondents said their organization was on the sidelines with no technology modernization initiatives planned for now.

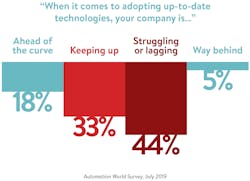

Advanced technology adoption: Are you ahead, keeping up, or behind the curve?

The question at the heart of the survey was: How do you feel your company stacks up against its peers in implementing advanced technologies? Nearly one-fifth (18%) said they are “ahead of the curve,” while one-third (33%) said they are “keeping up.” However, 44% felt they are “struggling or lagging” and 5% rate themselves as “way behind.”

Most of the technology suppliers we spoke with felt our findings tracked with what they are seeing in the market. With that noted, Matt Newton, senior portfolio marketing manager, asset performance management at Aveva, cautions that such results tend to vary by market. Asset-intensive industries—like oil and gas and power generation—are likely to adopt earlier than many other sectors. “We see those industries at the point of the spear for technology adoption,” he says. The more expensive the equipment, the easier it is to cost-justify advanced technology that enables time- and money-saving asset management and preventive maintenance measures, he adds.

In contrast, Peter Zornio, CTO at Emerson, was surprised to hear that more than half (51%) of our survey respondents felt they are either ahead or keeping up. “There is so much written about great technologies. Many feel they are missing out on a big party,” he says. Most executives, managers, and operations staff he interacts with feel they are not as far along as they should be.

Strikingly, companies that rated themselves as ahead and those that rated themselves as behind looked to the executive suite for praise or blame. Leading-edge respondents noted forward-thinking executives, management buy-in, and company strategy as crucial to propelling their progress.

Executive leadership is crucial to make technology-driven shifts stick, says Zornio. After all, implementing digital technology means people are going to have to change their work processes, and change is often painful. This is especially true in manufacturing environments, where change has proceeded at a glacial pace. “It’s not enough to just provide the budget to buy the technology,” he says. “If people know the person at the top cares about differentiating through new technology, then everyone will understand they are rewarded for that versus being the one who cut costs the most.” To overcome the difficulties of change, leaders have to make clear their strategy and how the business will improve. When they accomplish that task, their companies leap ahead.

Ben Huggins, vice president of sales for Honeywell Process, hears successful managers talking about things like new operating models, new ways of working and a focus on solving problems. “These leaders are not just about setting that right climate for the change but making sure the culture comes along,” says Huggins. “Leading companies set very aspirational goals and they quickly test their hypotheses. That allows them to experiment and grade the solutions they are implementing on a smaller scale, which leads to speed,” he says.

On the other hand, when things did not go well respondents were just as likely to cite the lack of management support as a critical factor in their being behind. The technology suppliers we spoke with agreed that management deserved the kudos as well as the raspberries when digital maturity lags.

Everyone knows the future is digital, says Newton, but some leaders might not yet have the vision for what that means for their own organization. “They know they need to start but they don’t know where,” he says. They’re collecting loads of data from the plant and factory floor, but they don’t yet see how that data might unlock new business models and revenue streams. None of this is obvious. “A lot of folks are trying to figure out what is the first step, what technology and projects should they be tackling.”

To the engineering staff, dithering while others take advantage might well come off as a failure of leadership.

Technology vendors do share at least some of the blame, adds Michael Risse, CMO at Seeq, a provider of advanced analytics for process manufacturers. “Vendors are failing to provide opportunities to start small and prove themselves versus requiring a big, top-down investment. You hear people talk about getting out of [proof of concept] hell but we haven’t seen that as an issue.” The best practice is to start small, expanding what works or else moving on to the next experiment. Without a concrete starting place in mind, executives should lean on their technology providers for ideas.

Controlling the purse strings

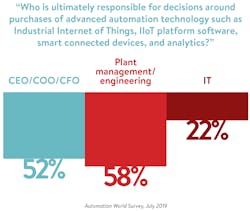

When it comes to deciding to go forward with a specific advanced technology investment, the respondent companies were pretty closely split between corporate and plant management decision-makers. The technology providers interviewed generally agree top management approval is required for large purchases. But plant managers make autonomous purchases under a certain amount, as they know what is needed and what works.

The chief technology officer (CTO) can play a critical role in bridging operational technology (OT) and information technology (IT) when buying advanced solutions, says Huggins. “They are able to balance both sides, buying things that work and add real value, without rogue elements. With big data and data analytics, more and more of that is happening outside the plant. But plants are running the proofs of concept and use-case development,” he adds. “Someone has to make sure it works.”

In Zornio’s experience, most of the automation technology buying decisions are still made at the plant level. “That’s because the automation equipment has historically been bought like any other capital piece of equipment—automation the machine builder or plant designer already decided on.” But when it comes to buying technology to improve plant and factory performance, “now we are seeing people trying to make more strategic corporate decisions with digital transformation teams at the corporate level.”

According to the survey, most manufacturers have designated a specific role to head up digitization efforts, with titles such as “chief digital officer” or “head of digital transformation.”

“Some companies are highly centralized with central ownership, some are highly decentralized with purchasing and decisions in the plant,” says Risse. “What is needed in either case is a leader/owner/champion to evaluate and act.”

The technology providers we spoke to did not see much of a distinction between the views of U.S. manufacturers on their state of digital maturity vs. those of manufacturers in the rest of the world. The U.S. and Europe may have started out ahead on advanced technology adoption, but Asia and developing regions soon caught up, says Zornio. “In the Middle East and Asia, they all have joint ventures” with large partners in other regions.

“We see worldwide interest in the next generation of innovation—what’s beyond the last 30 years of historian and spreadsheet—as the backbone of analytics,” says Risse. Everyone, it seems, wants the benefits that advanced technologies bring.