It’s pretty clear that something dramatic is happening in the manufacturing and production industries in the U.S. And it’s not just from the boosterism of politicians, trade groups or the media. There is tangible change all around us underscoring real activity in the U.S. manufacturing sectors. For a small sample of this, see my earlier blog post on the explosion of manufacturing in the Southeast.

We all know things aren’t going to go back to the way they were in the decades just after World War II. So just what is this change all about?

To gain some insight beyond what I’ve heard during interviews with end users, system integrators and technology providers, I looked at McKinsey Global Institute’s recent report on “Manufacturing the future: The next era of global growth and innovation”, which was released late in the fall of 2012.

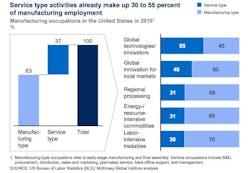

Of particular interest for me was the report’s discussion about the blurring lines between manufacturing and services. The report notes that manufacturing has always included a range of activities in addition to production, but that service-like activities—such as R&D, marketing and sales, and customer support—have become a larger share of what manufacturing companies do. According to the McKinsey report, “more than 34 percent of U.S. manufacturing employment is in such service-like occupations today, up from about 32 percent in 2002. Depending on the segment, 30 to 55 percent of manufacturing jobs in advanced economies are service-type functions and service inputs make up 20 to 25 percent of manufacturing output.”

The report estimates that 4.7 million U.S. service sector jobs depend on business from manufacturers. Explaining this further, the report states that “manufacturing companies rely on a multitude of service providers to produce their goods, including telecom and travel services to connect workers in global production networks, logistics providers, banks, and IT service providers.”

Combining job count across the total manufacturing and manufacturing-related service sectors means that total manufacturing-related employment in the United States would be 17.2 million, versus 11.5 million as cited in official 2010 data.

Explaining how this connection goes beyond job creation and into economics, the report says that for every dollar of output, U.S. manufacturers use 19 cents of service inputs, creating $900 billion a year in demand for services, while services create $1.4 trillion in U.S. manufacturing demand. And this connection holds true on a global basis. McKinsey says that “in China, manufacturing creates $500 billion in services demand, and services demand $600 billion a year in manufactured goods. And while manufacturing drives more than 80 percent of exports in Germany, services and manufacturing contribute nearly equal shares of value added to the country’s total exports.”

I plan to share more interesting insights from this report in future blog posts. In the meantime, let me know what you think of McKinsey’s observation about the blurring of the manufacturing/services divide in the comments section below.