News of industrial automation companies joining forces through partnerships, joint ventures, or mergers is certainly nothing new. Most such news, however, tends to involve one of the major automation companies working with a smaller supplier. Many of these relationships, if successful, are precursors to the larger company acquiring the smaller company and its product line. This is especially true in the software arena.

But just a couple of months ago, two automation software providers — neither one of which would currently be considered a massive global automation presence — began working together to deliver a platform-agnostic manufacturing intelligence software package.

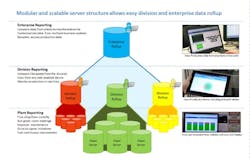

The relationship began with ZPI Inc., a supplier of enterprise manufacturing diagnostic software for assessing asset reliability, looking for a better option to extract PLC data that it uses to improve top-line performance, reduce waste, and help manufacturers produce more products in less time. ZPI’s software is based on the company’s own data collection and reporting engine that gathers details directly from programmable logic controllers (PLCs), applies business rules to those data, stores it all in an SQL database, and then makes it available for use in assessing performance by anyone in the company, from operators to upper management.

The PLC data extraction problems ZPI encountered occurred when ZPI used the PLC manufacturer’s software to access PLC data. Typical issues involved dropped data points and PLC drivers selecting incorrect numbers. To address these issues, ZPI started looking for options other than the PLC manufacturers’ software. One of the companies ZPI investigated was Kepware Technologies.

Kepware develops communication and interoperability software for the automation industry to connect, manage, monitor, and control diverse automation devices and software applications. The company’s product, KEPServerEX, for example, is designed to connect disparate devices and applications, from plant control systems to enterprise information systems.

ZPI team put KEPServerEX and the PLC manufacturers’ drivers in a head-to-head test. While conducting these tests, ZPI learned that the data management problems it often encountered with the PLC manufacturers’ software were exacerbated when deployed on high-load or poorly designed networks —a situation that is not uncommon in many manufacturing environments in both the discrete manufacturing and processing industries.

“Many of our clients’ networks simply weren’t designed right from the get-go; some were even token-ring environments. And when you layer drivers gathering data on an inferior network, it rapidly gets overloaded, causing lost and incorrect metrics,” says Paul Mancini, vice president of marketing and innovation at ZPI.

KEPServerEX, however, not only captured the correct statistics ZPI sought, but also kept them continuously up to date regardless of network architecture, which is a critical factor in enabling ZPI’s software to function as advertised. As a result, ZPI has selected Kepware as its OPC server provider.

Beyond the general market insights about how companies such as these are working together to improve each other’s products for the industry, this post also offers a lesson in the kinds of questions to ask if you’re looking into any sort of third party asset management or manufacturing intelligence software. Make certain to learn all you can about how the software you’re investigating will interact with the systems you already have in place. Lacking a viable fit between the two systems, the intelligence you get from the new software could be anything but intelligent.