For a production supervisor, it’s the stuff of nightmares: Somewhere on the line, a tiny milling bit breaks, shutting down the line. This unplanned downtime is not only costly, it causes delays that spell major headaches for that supervisor.

Unplanned downtime has been a nemesis of manufacturers from day one. Absent special technology, however, it’s hard to cut down—the causes are complex and not readily visible. Now, tools equipped with artificial intelligence (AI) and its more advanced progeny, machine learning (ML), are helping manufacturers not only reduce unexpected downtime but also achieve better yields and improved quality.

It’s no surprise that AI and ML have reached into manufacturing production—the technologies are exploding in every industry. In the manufacturing sector, leveraging AI tools and capabilities is a natural outgrowth of the fact that there is more data being generated on the shop floor than human beings can cope with. Monitoring equipment via the Industrial Internet of Things (IIoT) is fine, but how are operators supposed to know if an alert is real or just another false positive?

Finding and fixing problems as quickly as possible on the production line is important. Right now, troubleshooting often requires an engineer to fly to the site and spend time tearing down the system to find the problem. Using vision systems combined with ML capabilities, potential issues can be proactively identified and fixed before they become problems.

Keeping it real

Implementing AI in your production environment should not just be about getting the coolest new technologies, however. The use of AI needs to be firmly anchored in improving manufacturing outcomes.

“We see people asking for AI,” says Jeff Erhardt, vice president of intelligent systems for GE Digital. “They don’t know what it means or how to use it, but they knew they needed to buy it.”

Just buying a new tool with AI capabilities and then figuring out where to use it is not a strategy that is likely to improve outcomes. “The big value comes when you are very thoughtful about where these technologies are applied and how,” Erhardt says. “They have the ability to take away mundane, repeatable, boring decision-making on top of data, freeing up the human capacity to solve new problems, invent new products and to be creative in ways that the computers can’t be.” But AI and related technologies can be expensive to buy, implement and maintain.

GE systems offer a wide range of AI capabilities, including its Asset Performance Management (APM) suite. The intelligence embedded in this software helps human operators quickly discern which problems are real vs. those that are not, Erhardt says.

“Let’s say you’re monitoring production equipment for anomalies,” he describes. “You have alerts going off. But what do you do next? How do you know if it’s real or not?” The cost of ignoring those alarms and allowing a breakdown in the production system can be very high. But if it turns out you took equipment down for maintenance unnecessarily because of a false alarm, that can be incredibly expensive as well.

Raven Telemetry is a software startup that attempts to solve this issue by giving human operators guidance on the shop floor, as opposed to just alerts. In addition to analytics, Raven Brain uses tablet computers on the shop floor to collect process data, providing a basis from which to learn.

“When we detect a problem, we ask the operators to record what is happening and enter notes,” says Martin Cloake, Raven’s CEO. “That gives us a data set that describes what the machines are doing but also gives context from the operator. That’s how we get our data set.”

The system then provides guidance to the operator on how to respond. The most pressing items are situations that could lead to sustained unplanned downtime or poor-quality output, which are the enemy of the all-important metric of overall equipment effectiveness (OEE).

A big reason why the time is ripe for AI-enabled intelligent manufacturing is that the cost to collect data from machines and processes has gotten considerably lower. It’s also gotten easier and cheaper to house great quantities of data in the cloud. Manufacturers in process and discrete industries are seeing the possibilities.

“Manufacturers are all looking for ways to improve output,” Cloake says. “There is massive potential in the data, but they don’t have the tools or resources to attack it.” The sweet spot: using a simple tool that does not require much from the human operators while delivering real value in return.

The Emerson Acoustic Transmitter listens to a pressure relief valve for sounds that indicate the valve is releasing gas. The Plantweb Insight app then provides guidance to the plant operator on what to do about the event.

What’s causing that problem?

Aveva’s PRiSM Predictive Asset Analytics was developed to optimize line performance in the power industry, and is now being used in the food and beverage sector as well as other process industries. The system has ML capabilities that learn over time, says Matt Newton, senior portfolio marketing manager for the asset performance management business at Aveva. “It’s doing an advanced form of pattern recognition that uses an algorithm to figure out how to interpret data,” he says. “We can spot trends and identify trends and problems days and weeks before they occur.”

Uptake takes a similar approach to the market, offering a platform that combines material, process and equipment data with predictive insights, helping manufacturers take immediate action to maximize the uptime of assets, increase production throughput and improve yield. “Data is the new gold out there,” says Brad Kerr, vice president of manufacturing for Uptake. “We have content on over 800 different assets in different conditions and the corrective actions that you take on those assets.”

Emerson has incorporated predictive intelligence into its Plantweb digital ecosystem through an offering called Insight Applications. These apps combine analytics with domain expertise to turn plant asset data into actionable information. Operators and managers can access the information via dashboards and charts on a web browser without special training, according to Brian Joe, Rosemount wireless product manager for Emerson Automation Solutions.

Plantweb Insight for pressure relief devices helps operators understand how to interpret data that indicates a fluid release event. For example, in the case of petroleum production, producers are required by the U.S. Environmental Protection Agency (EPA) to provide a detailed report of all releases of the gaseous byproducts of crude oil. Over-pressure situations can put the plant and personnel in danger, so pressure relief valves send gases and vapors to a flare stack for burning. Emerson Rosemount transmitters listen for sounds indicating releases that would be inaudible to human ears.

The acoustic transmitter can report the time the discharge began and ended, while giving some indication of how serious the discharge was based on the amplitude of the sound. The app interprets that data, eliminating graphic interpretation by operators and false positives. The app can provide faster and more comprehensive analysis than a human operator is capable of, Joe says, and automatically disseminates results to business executives and regulators.

“The expert can quickly interact directly with the data of interest to solve process problems, without the need for an IT expert,” Joe adds.

Looking ahead

Siemens is another traditional automation vendor investing heavily in AI—partnering with academic institutions, groups like Advanced Robotics for Manufacturing (ARM), governmental bodies and other companies on work that will pave the way for future use of robotics and AI on the shop floor.

One such project is evaluating AI’s potential use in automation engineering, says Gustavo Quirós, Siemens senior key expert. Siemens expects to have an internal prototype by the middle of next year that will prove it is possible for a system to be a valued partner in reducing non-value-added plant engineering tasks.

“Because the system is learning and transmitting how to do things better, it will level the playing field,” Quirós says. “The productivity of new people will be higher.”

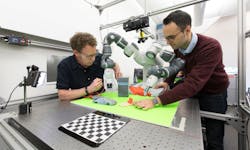

Siemens is also using AI to help robots be more productive. In an environment where manufactured products are becoming increasingly customized, robots have had a more difficult time than humans learning to cope with the high number of changeovers and different types of materials used.

Though humans are flexible, they won’t be able to handle the level of work required when more and more products are made in quantities of one, says Juan Aparicio, head of advanced manufacturing automation for Siemens.

The research relates in part to grasping objects, which is a relatively difficult task for robots, particularly when the objects on a line are not the same. Without even attempting to replicate human dexterity, AI can do much to refine the two-fingered grippers already in widespread use in robotic bin-picking applications, Aparicio says. “They can get better over time. The robots will learn.”

Siemens has developed a neural network that contains more than 100,000 objects and returns the best grip for an object. In the latest results, robots can achieve 300 picks per hour, half of the human rate. “The robot is getting there,” Aparicio says. “Depending on the industry, a combination of both robots and humans makes sense.”

It is still early days for AI’s use in a production setting. But early work shows tangible results are within reach for manufacturers that are not carried away by the hype. Aparicio likens AI to the ingredients in a chocolate cake. “If you just have chocolate, you don’t have a cake.”

Leaders relevant to this article: