Though we’ve all been dealing with adjustments to life and business amid a global pandemic for a few months now, data is still trickling in about industry’s plans around digital transformation from the time before COVID-19 changed the game for everyone. Like the survey data from the Eclipse Foundation about IoT adoption we covered recently, new data from Nokia and ABI research provides us with a pre-pandemic marker from which we can more accurately monitor technology adoption trends pre- and post-pandemic.

The Nokia/ABI Research project surveyed more than 600 manufacturing decision-makers in late 2019 to assess investment strategies related to 4G/LTE, 5G, and Industry 4.0. Eighty-eight percent of respondents to the survey stated that they were familiar with private wireless (4G/5G) networking, with 84% considering deployment of a 4G/5G local private wireless network in their manufacturing operations.

More specifically, the survey revealed that 74% of respondents are looking to upgrade their communications and control networks by the end of 2022, with more than 90% investigating the use of either 4G and/or 5G in their operations. This intent is underscored by survey results showing that more than half of the respondents (52%) believe that the latest generation of 4G/LTE and 5G will be necessary to meet their transformational goals.

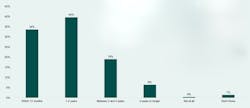

Respondents indicated their growing interest in 4G/LTE and 5G relates to: the need to digitalize and improve existing infrastructure (63%), automation with robotics (51%), and increase employee productivity (42%). More specifically, priority buying areas related to 4G/LTE and 5G include automation and machine upgrades (47%), IIoT initiatives (41%), with cloud infrastructure following at (37%).

Joe Hanley, communications lead for Nokia Enterprise, said, “If we were to conduct this survey again today, since the emergence of COVID-19, cloud infrastructure would probably rank higher because that enables remote visibility and remote monitoring—a very apparent need in the wake of COVID-19.”

He added that Nokia is seeing interest in cloud capabilities accelerating as a result COVID-19, as is interest in digital twins and simulation software in general, and in new service models.

“The manufacturing sector as a whole is going through massive transformation,” said Hanley. “Automation has been focused on the line level for a long time, but now manufacturers are beginning to think about system-level automation—and that means upgrading the machines used and the infrastructure. One of the reasons for automating more things is that it provides more mobility in terms of moving raw materials into the facility and then out as finished products. Underpinning that mobility will be more wireless—private, dedicated cellular networks to support the new infrastructure.”

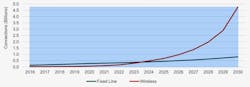

According to Nokia, in 2019, the majority (86%) of global factory connections were fixed line. Based on this survey data, Nokia predicts that number to fall to 40% by 2025 and 14% by 2030. The company expects fixed line installation to grow by 12% between 2019 and 2030, as 4G increases by 14.7%, LPWAN and LTE grows by 93.8%, and Wi-Fi use expands by 29.8% during that same time frame.

Hanley said this transition, which is already beginning, is happening more in the discrete manufacturing verticals like automotive, electronics, consumer goods, and machinery than it is in the process industries.

“One of the big changes here is around monitoring. It’s been happening since the advent of M2M (machine to machine) communications and even now a lot of industrial IoT is about monitoring. But the chasm we’re crossing now is about wireless control,” he said. “To integrate monitoring and control capability is profound and it will happen over a period of time because dedicated private networks really enable that. For the three tech areas I mentioned—cloud, digital twins, and service models—they all rely on capabilities delivered by dedicated private cellular networks—real time data, simultaneous information sharing, and democratization of decision-making as result.”

In its study, Nokia and ABI Research predict that, by 2023, a “vast number of the 5.5 billion digital factory connections will be wireless. Most of these connections will be entirely new (automated guided vehicles, modern HMIs, sensor networks, advanced asset tracking, etc.) and support by private LTE and 5G.”