Industrial Ethernet Growth Continues as Fieldbus Declines

A lot has changed in the automation sector over the past 20 years and industrial networks are no exception. In the early 2000s, many engineers questioned the viability of Ethernet use on the plant floor. Now, years of industrial Ethernet adoption on the plant floor—driven by digital transformation initiatives and increasing alignment between IT and operations technology groups—is visible in declining use of fieldbus.

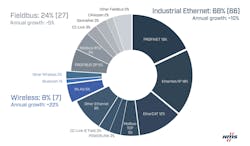

According to HMS Networks, an independent supplier of industrial networking products, the industrial network market is expected to grow by 7% in 2023. Industrial Ethernet accounts for 68% of all new installed nodes (up from 66% in 2022) while fieldbus networks declined to 24% (from 27% in 2022).

These figures from HMS are based on the number of new installed nodes in the discrete manufacturing industries. HMS defines a node as a machine or device connected to an industrial field network. The company notes that its figures “represent HMS’ consolidated view, considering insights from colleagues in the industry, our own sales statistics and overall perception of the market.”

Among industrial Ethernet protocols, HMS says Profinet and EtherNet/IP share first place in the network rankings with 18% market share, followed by EtherCAT at 12%. In the industrial Ethernet category, HMS points out that wireless Ethernet is growing fastest, with an increase of 22% expected in 2023. Typical use cases for wireless Ethernet include cable replacement applications, wireless machine access and connectivity to mobile industrial equipment.

Though HMS’ 2022 study showed some growth for fieldbuses, this year’s study shows a decline. In the fieldbus category, HMS notes Profibus leads the fieldbus rankings with 6% market share, with Modbus-RTU close behind at 5%.

HMS adds that, although the number of new fieldbus nodes are declining, numerous devices, machines and factories will still rely on fieldbuses for many more years.