Machines-as-a-Service: This Trend Is Just Getting Started

Industrial manufacturing verticals that are well-recognized as early adopters of advanced technologies, such as automotive and aerospace, have made big strides with software- and machines-as-a-service over the past several years. Until very recently, however, the same could not be said of other industrial verticals. COVID changed that perception—dramatically and rapidly.

The reticence in some industry verticals to allow third parties to remotely access equipment in their plants has largely vanished in the wake of nearly every aspect of operations going remote to at least some degree.

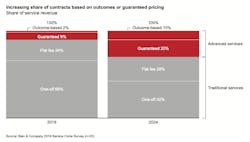

In fact, so much around this issue has changed so quickly that Bain & Company now expects that OEMs “will sell most equipment as part of bundled solutions” by 2030—including software and services, thereby reducing hardware’s share of total profits.

What this means for OEMs

Many equipment manufacturers have seen this trend coming for years now, even if COVID-related accelerations caught them off guard. A good example of how OEMs are already adapting to this new reality can be seen in the video below from Pearson Packaging Systems describing the company’s approach to the MaaS trend.

The Bain report notes that by “building on a deep knowledge base and decades of experience, OEMs are redefining traditional machinery service as strategic care and designing new services that help customers perform better throughout the full life cycle of the installed machinery base.”

To be successful in this new MaaS era, Bain says OEMs “now need to collaborate more closely with their customers. Advanced service contracts, for example, are broader in scope and may cover a full production line, all the equipment at a given site, multiple plants, or even an entire fleet. The most effective equipment makers compile data and insights from their installed base and use the information to build innovative service solutions.

Companies leading the shift to advanced services and solutions understand that equipment and service are no longer two separate businesses but are deeply interconnected.”

Insights from China

Though the MaaS trend may not yet be very visible here in the U.S., it has developed rapidly in China. According to Bain, “Chinese machinery companies…started innovating in services a decade ago to spur growth as equipment sales slowed. The [China] market is now a vibrant testbed for a future service- and solutions-based industry. One Chinese OEM that has reinvented its service offering is heavy equipment maker XCMG. The company’s internet platform, which provides services such as machine analysis, average working time analysis, equipment utilization data, and connected plants, has generated massive growth since its launch eight years ago. At the end of 2021 it had connected more than 460,000 machines. XCMG says its services give companies a competitive edge: greater efficiency and faster decision making based on data.”

Four key steps for OEMs

In its report, Bain outlined four steps OEMs should take to better position their operation amid the growing MaaS trend:

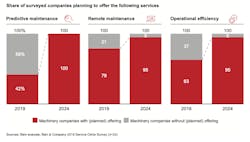

Digitize and connect the installed base. Bain says OEMs need toinvest in connected equipment and cloud-based platforms to create a trove of information about customers and their equipment. Such digital tools allow for most customer support to be managed remotely, reducing costs involved in servicing the installed base and dramatically improving overall efficiency. Digital portals also provide customers access to operating data, further enhancing the OEM/customer relationship. Also, sensors embedded in connected equipment can help OEMs anticipate machinery failures before they happen and offer customers a quantum leap in preventive maintenance.