If you add up all the offshoring that took place over the past two decades and subtract some portion of that to account for the decent stream of re-shoring that’s been going over the past few years, what do you have?

I don’t know either, but I do know that accounting for the current value of manufacturing in terms of past offshoring and recent re-shoring is a difficult, if not impossible, task. Regardless, that’s exactly what many discussions on the state manufacturing in the U.S. are based.

A more dependable estimate of the value of manufacturing to the U.S. economy is data from the U.S. Census Bureau, which recently released some new data from its 2011 County Business Patterns and Survey of Manufacturers projects.

The first thing I found interesting in this release is that number of manufacturing facilities in the U.S. still hovers around 300,000 — which is pretty much where it was in 1990. While it's clear that offshoring impacted millions of jobs and lead to the shut down of numerous manufacturing facilities, the overall number of manufacturing facilities in the U.S. has remained fairly stable over the past 20 years. Some will argue that this number should have grown significantly if it weren’t for all the offshoring, but what happened happened. What’s important now is the current state of the industry and forward-looking trends.

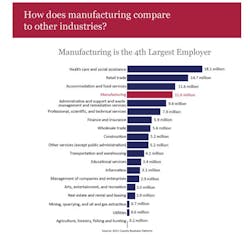

Looking at some of the key figures reported in the Census Bureau’s release, manufacturing is currently the fourth largest employer in the U.S., employing 11 million people. This means that manufacturing trails only healthcare, retail and hotel/food services industries in terms of employment.

The average annual salary of a U.S. manufacturing worker was $52,300 in 2011—27 percent higher than the average U.S. worker’s salary in 2011 (which was $41,211 in 2011, according to the Social Security Administration).

Considering the importance of exports to the economy, it’s notable that manufacturing still accounts for more than half of our export dollars—6 in 10 of U.S. export dollars were generated by manufacturing in 2011.

Of course, exporting is only half the economic equation, with consumption being the other half. According to the 2011 Annual Survey of Manufacturers, U.S. manufacturers spent $3.2 trillion on materials in addition to spending $147 billion on capital expenditures.

Sectors of the manufacturing industry that are performing the best, in terms of shipment value, are: petroleum and coal products ($837 billion), chemical ($777 billion), food ($710 billion), and transportation equipment ($690 billion). From there, the size of the industry sectors, in terms of shipments, are considerably smaller, with the next category—machinery—clocking in with $366 billion in shipments, about half of the shipment value total of the equipment sector.

In terms of energy management, data from the 2011 Annual Survey of Manufacturers shows that manufacturers—the largest industrial consumers of energy—are getting more savvy about generating power and making money from it. According to the survey, manufacturers generated 119 billion kilowatt hours of energy and sold nearly 35 billion kilowatt hours of energy.

All in all, it seems like the increasing focus put on U.S. manufacturing over the past several years by both entrepreneurs and government looks to be paying off.

Leaders relevant to this article: