With several forces behind it, the push continues for increased services and support from automation suppliers in the process industries. Consulting services, project engineering and installation services all present high growth opportunities in greenfield projects; and there are similar demands for maintenance, support and operational improvement services in brownfield projects, according to new analysis from Frost & Sullivan.

Driving these areas of growth include such trends as declining availability of a skilled workforce, which pushes responsibility for operation and maintenance services to automation companies. Also, increasing competitive pressures encourage manufacturers to look to automation for operational improvement services to avoid costly downtimes, optimize production, improve energy efficiency, and mitigate risks.

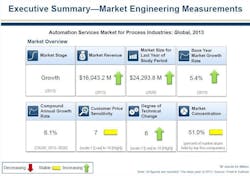

Frost & Sullivan reports that the market for process automation services earned revenues of $16.04 billion in 2013, and is expected to reach $24.29 billion in 2020. Greenfield projects in the oil and gas industry, expansion projects in the chemical industry, and integration projects in the hygienic industry are key factors to tis growth.

“The automation services market is primarily driven by engineering, procurement and construction (EPC) firms, tier 1 automation providers, and system integrators,” said Naveen Kumar Ramasamy, industrial automation and process control senior industry analyst for Frost & Sullivan. “End users will accept automation solution providers, in particular, as reliable service partners in the long term as they seek more comprehensive single-window services.”

System integrators are moving up the service value chain, Ramasamy noted, because of increasing bench strength and capabilities. They are capturing a greater share of the automation services market, affecting profitability for established solution providers. Also, those automation providers are taking a hit in price-sensitive emerging markets such as India, China, Brazil and Vietnam.

Although the aging workforce in many markets will force adoption of remote services with cross-industry expertise, cybersecurity threats are curbing use of remote monitoring and diagnostics services in developed countries, Frost & Sullivan reported.

“To address opportunities in a specific end-user vertical in a specific region, global automation market participants must concentrate on building service-based organization capabilities in the short term and consolidate the resources in the ecosystem during the medium term,” Ramasamy said. “They will reap the benefit of this sustained revenue stream during the long term of the forecast period; that is, in five to seven years.”

Finally, Frost & Sullivan pointed to “glocal” services—a global presence with local availability—as being important for the chemical, oil and gas, and food and beverage sectors in North America; pharmaceuticals and power in Asia-Pacific; water and wastewater in Europe; pulp and paper in Latin America; and metals and mining in Africa and South America.

Leaders relevant to this article: