It’s no secret that the industrial sector remains one of the most vibrant sectors of the global economy. Though it may trend downward for a period of years in one region or another (or even a few at a time), manufacturing in its discrete, process and batch forms has been growing consistently over the past decade on a global basis.

Today, growth in the industrial sector is at a very high point across the globe; and that impacts the global economy significantly, considering that the current GDP of the global industrial sector would make it the 53rd largest economy in the world (if it were a country). According to IHS, global equipment revenues for 2014 are expected to reach $185.3 billion. Motors and motor control will comprise 40 percent of these revenues, with automation equipment accounting for 31 percent and power transmission equipment accounting for 29 percent. As for how the dollar spend across these areas is expected to break out, IHS predicts that $47.4 billion will be spent on motors, $26.9 billion on motor controls, $36.5 billion on linear and fluid products, and $31.8 billion on discrete control.

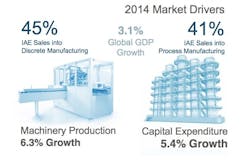

Spending in the manufacturing sectors will be nearly evenly split, according to IHS, with process industries accounting for some 41 percent of industrial equipment sales and discrete manufacturing accounting for 45 percent of sales. This prediction came as something of surprise considering the past few years of growth in industry have largely been driven by the process industries through explosive growth in the energy sector (namely oil and gas).

Alex Chausovsky, manager and principal analyst for IHS Industrial Automation, says he is seeing increased automation spending in the machine-building sector “due to pent up demand. Plus, pump, fan and compressor providers are starting to be motor suppliers too.” (NOTE: Alex Chausovsky will deliver a presentation at The Automation Conference explaining the impact of regional motor efficiency legislation being enacted by governments around the world and the effects that more expensive higher-efficiency motors are likely to have on the repair vs. replace decisions facing motor users.)

IHS predicts the machinery market to achieve 6.3 percent growth in 2014, while the process industries are expected to increase capital expenditures by 5.4 percent.

More specifically, Chausovsky says that he sees a great of potential for the intelligent motor control market. He expects this market to grow even more than the general motor market. One of the potential drivers of this growth could come from an expansion of how different markets consider motors and motor controls. The European market looks at efficiency across both motors and motor controls, he says, whereas the Asia and U.S. markets tend to look at motor efficiently separately from motor controls efficiency. If the more holistic European approach spreads, due to the efficiency successes achieved in Europe with this approach, it could have a big effect on the market.

The reason the spread of this approach could have a big impact on the market lies in the upside potential for the Americas market. IHS sees the Americas fast becoming the dominant growth engine for industrial automation sector. According to IHS estimates, industrial automation sales will grow by 6.9 percent in the Americas—nearly equal to that of Asia, which IHS expects to grow 7.7 percent. In comparison, EMEA (Europe, Middle East and Africa) is expected to grow by 4.3 percent and Japan by 5.4 percent.

Looking into the not-too-distant future, IHS expects 3D printing to be the principal driver of a coming industrial revolution. Though we’ve all seen the amazing things 3D printing is bringing to consumer and medical products, not many people are aware of the impact the technology is having on the production of industrial tools, fuel injection nozzles, gas turbine parts and pumps.

Aside from the clear benefit of being able to produce a prototype in days rather than months, the key benefits IHS sees in 3D printing for manufacturing are:

• The additive manufacturing process, wherein materials are added to create a product in 3D printers rather than subtracted, minimizes or even eliminates waste compared to traditional “subtracting” processes to create products. This presents significant potential cost savings to manufacturers, says IHS.

• Because 3D printed products are designed using computer software and then printed layer by layer, this process allows for the incorporation of features that are not possible with traditional manufacturing techniques.

3D printing technology is not without current drawbacks, however. IHS notes the biggest concerns being the technology’s current size and speed limitations, which “prevent the technology from replacing many assembly line manufacturing processes.”

The coming industrial revolution driven by 3D printing may still be a ways off, but it’s clearly no longer the stuff of science fiction. Its benefits are clearly tangible. As Dr. Detlef Kayser, director of McKinsey & Company in Hamburg, Germany, said during the Siemens press conference at Hannover Fair: “3D printing is heavily hyped today, but undervalued long term.”

Leaders relevant to this article: