It’s been hard to miss, but, in case you hadn't noticed, attention in the industrial space has been moving from a principal focus on a manufacturing renaissance in China and the U.S. and toward a heightened interest in cloud-based Industrial Internet of Things-directed software, hardware and systems. With this shift in mind, an updated outlook on the economic future of the industrial automation market was needed. To deliver this, Morgan Stanley Research reached out to Automation World to develop a partnership around a research project designed to “shine a light on the risks and opportunities” as the automation industry evolves toward its cloud-based future.

The results of this Morgan Stanley research are directed toward investors looking to select the best investment targets for their portfolios. However, the report also delivers valuable information for buyers, specifiers, and users of industrial automation technology.

Some of the key findings of the Morgan Stanley/Automation World research include:

Industrial Internet of Things (IIoT) opportunities are real and a key driver of industry growth. Morgan Stanley expects IIoT-related spending to increase from ~8 percent of industrial companies’ capital budgets to ~18 percent over the next five years. According to the report, “discrete automation is expected to see the greatest [IIoT-related] growth opportunities given faster upgrade/replacement cycles and lower penetration of software compared to the process industries.”

Cloud-based analytics has the potential to disrupt the traditional business models in the industrial market. According to Morgan Stanley, “While automation players do compete effectively with the likes of Oracle and SAP in manufacturing execution system and asset management software, the increasing adoption of cloud-based data analytics opens up the potential for non-traditional IT and software competitors to enter the frame, such as GE’s Predix platform.” Impacts to the business models of traditional IT suppliers are not the only disruption predicted by Morgan Stanley. “Our survey also highlights the risk that the high-margin PLC could become a less central component of the automation system longer term,” the report says. If you're a regular reader of my blog, this last point about the centrality of the PLC may sound familiar. In my recent “Will Controllers Become Part of Edge Nodes?” post, GE’s Vibhoosh Gupta explained how virtualization, connectivity and security are leading to an era where edge nodes will house controllers, rather than having the controller reside at the heart of an automated system.

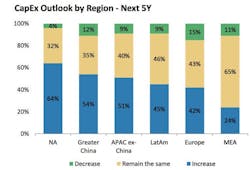

The outlook for automation investment remains bullish. “We believe recent macro volatility has not significantly altered a bullish medium-and longer-term outlook for automation investment,” says Morgan Stanley in the report. “Customers … are expecting ~4 percent growth in total capex over the next 12 months, slightly below the +5 percent result seen in August 2015. Over the medium term, the majority of suppliers we interviewed also continue to expect the automation industry to grow at a faster pace than global GDP. By geography, North America stood out as a top priority in our survey respondents’ medium-term investment plans.”

Rockwell Automation, Schneider Electric and Siemens are seen as the best IIoT solutions providers across all the major geographies. Note that Morgan Stanley is not saying these suppliers are necessarily the providers of the best technology, but that they are the best targets for IIoT-related investment. Here’s how Morgan Stanley explains its listing of these three suppliers as prime investment opportunities: “We believe that this is a function of the fact that IIoT adoption is expected to be prevalent in discrete automation sectors, given faster replacement cycles and lower penetration of software vis-à- vis the more automation-centric and longer-cycle process industries.”

For more information and to access the full report, visit: www.morganstanley.com.

Leaders relevant to this article: