What was it that Benjamin Franklin said? Nothing’s certain except death and taxes? And pumps. Surely he said something about pumps. Because it really doesn’t seem to matter which way process industries move—prices up or down, environmental concerns in or out—pumps are on the rise. Particularly smart ones.

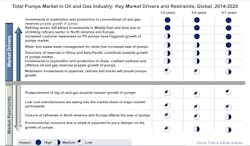

Continually falling gas prices may have the industry worried, but the fact remains that investments continue in the exploration and production of conventional oil and gas. Not to mention surging production of shale oil and gas in North America; oil sands in Canada; conventional reserves in Brazil, Venezuela and Mexico; and new deepwater and ultra-deepwater reserves in Asia-Pacific.

All of this, notes Frost & Sullivan, means a growing demand for pumps around the world. In a new report, analysts predict that the revenues of about $10 billion earned by the global pump market in oil and gas in 2013 will grow to more than $14 billion by 2020.

Similar to what Frost & Sullivan pointed out last year about pump use in the water/wastewater industry, oil and gas folks are also learning the benefits of positive displacement (PD) pumps over centrifugal pumps.

“Increasing awareness on the economical and functional advantages of PD pumps is prompting customers to slowly but steadily shift away from centrifugal pumps,” says Sakthi Sobana Pandian, industrial automation and process control research analyst for Frost & Sullivan. “PD pumps will prove indispensable in various applications such as hydraulic fracturing, the mixing and injecting of chemicals, and the mixing of solid proppants with water.”

The need for water and wastewater management during the extraction of gas and oil from shale has added to the demand for pumps. However, as environmental concerns threaten market growth, efficient pumps are gaining importance, analysts say.

Though closing refineries in North America and Europe adversely affect pumps sales, other opportunities have opened up for pump manufacturers in the Middle East and Asia-Pacific. Rising midstream investments in pipelines, railcars and trucks in these regions add to market potential, Frost & Sullivan report.

“The aftermarket sales and services segment will evolve into another gold mine in terms of revenue generation as need for replacements and retrofits rises,” Pandian notes. “Offering integrated solutions, services and asset-management technology will also quicken development in the global pumps market.”

Leaders relevant to this article: