There’s been a flurry of activity over the past few years indicating a greater reliance by manufacturers on product lifecycle technologies ranging from increased use of CAD/CAM/CAE software to full-blown product lifecycle management software suites. Just a few weeks ago I wrote about how expectations are growing for a PLM surge in manufacturing; shortly thereafter, GE and PTC announced that they have expanded their collaboration to include a reseller agreement and joint product development as well as sales and marketing. Clearly, there’s quite a bit of activity in the manufacturing PLM space, and where there’s smoke, there’s usually fire.

Throwing more fuel on that fire is a recent article by Jim Heppelmann, CEO of PTC, which was published in Frost & Sullivan’s Manufacturing Leadership Journal. The article, titled “Transforming the Relationship Between Products and Services”, looks at how more manufacturers are looking past single sales transactions and into “creating multiple opportunities for an exchange of value, and simultaneously transforming the relationship between manufacturer and customer.” This new business model is blurring the lines between products and services for many manufacturers and is leading to a “rethinking of nearly everything, from how products are conceived, designed, and sourced to how they are produced, sold, and serviced. We’re at the early stages of a fundamental transformation, marking what could be one of the most significant business model disruptions since the Industrial Revolution.”

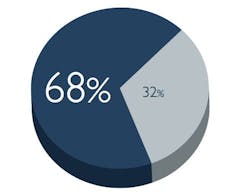

Heppelmann’s conclusions are, in part, based on data from a survey of 300 global manufacturing executives commissioned by PTC and performed by Oxford Economics, a global forecasting and quantitative analysis firm. Nearly 70 percent of responding executives said they expect their companies to undergo significant business process transformations over the next three years. The executives hold these expectations because they believe “they’re nearing a point of diminishing returns with their focus on improving manufacturing operations, with more than half saying they believe they’ve already wrung out almost all the potential savings from efficiencies in their production processes,” Heppelmann states in his article.

While this is undoubtedly true for many manufacturers, I have to wonder how true this statement holds for the majority of manufacturers. After all, less than a year ago I attended a presentation by Laurie Harbour, president of Harbour Results, at the Manufacturing in America Symposium. According to her analyses of current manufacturing data, manufacturers as a whole haven't become more efficient over the past several years. “The extra revenues being brought in now [due to the upturn in U.S. manufacturing] are just hiding the inefficiencies,” she said. The data she produced showed that revenue per full time employee in 2011 was $160,000, but was only $149,000 in 2012. In 2012 revenue increased 16 percent over 2011 but throughput went down 7 percent, she said, which represents about an $11,000 loss per full time employee.”

Read more about Harbour’s comments here.

In my assessment of these two viewpoints, it would seem that we have two worlds of manufacturers. One world is made up of the 10 percent (or so) of manufacturers that are organizations of significant size and resources. The other world is the majority of manufacturers—small to medium-sized businesses that often comprise the supply chain of the larger manufacturers in the top 10 percent.

The major manufacturers in the top 10 percent are the ones going through the transformation Heppelmann describes in his article. He lists several examples in his article to illustrate how the rise of smart, connected products is accelerating the pace of change for those manufacturers. In one instance, he cites auto-industry supplier Continental AG, which makes “windshield-wiper systems with rain-sensors and software that control how rapidly the wipers sweep across the windshield. Continental also lets car makers connect the sensors to vehicle-control systems that tell the car to roll up the passenger windows when rain starts.”

He also makes note of how Trane, a manufacturer of HVAC systems, is installing “extensive digital sensor systems” in its newest products that are connected to Trane’s Intelligent Services Center. “The center monitors buildings 24 hours a day, seven days a week, watching for systems failures or warning signs of trouble. Using proprietary analytics and subject matter expertise, Trane is fundamentally shifting its business model to offer optimized building operations as an ongoing business service to its customers,” Heppelmann says. “Trane Intelligent Services resolves 30 percent of HVAC problems remotely without sending a service truck. Some 40 percent of problems are diagnosed in 30 minutes or less. This allows Trane and its customers to reduce costs.”

Clearly the connection between products and services is an increasingly important one for manufacturers of all sizes. Even Heppelmann points to data from Oxford Economics that show more than two-thirds of manufacturers expect to use service as a differentiator by 2015, with more than half of them planning to establish a service profit center. Among European manufacturers, 82 percent said they will enhance services as a way to differentiate their products, compared to about two-thirds in the U.S. and Asia.

My concern is that too many small and mid-sized manufacturers, in their push to add services as a means of improving profit, will overlook the plethora of operational efficiency improvements they could make in the near-term that would drop more dollars to their bottom line far more quickly. If you’re not so certain there are enough efficiency improvements still lying in wait to be grasped by manufacturers, consider the recent release of ISO 11011, which deals largely with better management of compressed air leaks. Yes, that age-old source of wasted money still plagues industry enough that a standard needed to be developed to help address it.

For mid-sized or smaller manufacturers who might be struggling with decisions about whether to focus first on developing services offerings or efficiency improvements, I suggest you look before you leap and don’t miss out on how the money saved from efficiency efforts could help underwrite the development of a connected services offering in the near future. For those large-scale manufacturers out there who have invested the dollars on significant operational improvements over the years, if you're not already moving in the direction of connected products and services, it’s clearly time to get on the bus with the idea of connected products to accelerate your services revenue and decrease maintenance costs as Trane has.

Leaders relevant to this article: