While the manufacturing industry begins to buzz about the potential for a new open process control architecture that would enable easier interoperability between disparate plant-floor systems, automation suppliers exhibiting at the ARC conference in Orlando were focused on how to extract more value from customers’ existing control environments.

Getting the most out of automation equipment is important right now as plant-floor technology becomes increasingly complex while the workforce transitions to younger, less experienced operators. With that in mind, Yokogawa Electric Corp., Schneider Electric and Honeywell Process Solutions all have their own unique spin on how to keep operations productive and safe while leveraging legacy equipment for a competitive business advantage.

Here is a roundup of the recent announcements:

Yokogawa has been adding to its cloud, energy management and consulting portfolio through the 2016 acquisitions of Industrial Knowledge, SOTEICA VM and KBC Advanced Technologies, respectively. Now the company is rolling out a service offering that focuses on obtaining the best possible process performance and safe operation of equipment assets.

Yokogawa’s KBC company announced the Co-Pilot Program, a cloud-based real-time performance improvement tool that will focus first on oil refinery facilities. The service can remotely support a customer’s plant while providing insight into supplementing capabilities and resources that will help to reach the plant’s full potential. Leveraging the company’s simulation product for the hydrocarbon industry, the program will assure asset owners and operators that their simulation and planning tools are always up to date and that actions taken by operators result in the best process performance and safe operation of equipment.

“KBC [Co-Pilot] will sit alongside operations, either physically or virtually, and advise plant engineers on how to operate better,” said Andrew Howell, CEO at KBC.

The system offers real-time data connection to the plant, automatic recalibration of simulation models against actual plant data, regular health checks of unit performance vs. plan and potential and reset of the baseline operating plan due to major changes in external impacts including economics, demand or asset capabilities.

The Co-Pilot Program will be delivered in stages. First, remote monitoring and surveillance using engineering models and IT data to benchmark the plant performance and generate key performance indicators (KPIs). Second will be new KBC Co-Pilot programs for the supply chain and production optimization, which will roll out later this year. And in 2018, energy management and operator effectiveness will be addressed.

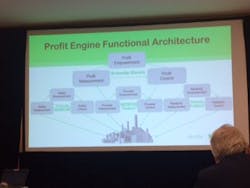

Separately, Schneider Electric announced a concept called the Profit Engine—an umbrella term for a line of products built on the EcoStruxure architecture—the first of which is the Profit Advisor, a technology jointly developed with Seeq, a provider of big data analytics for process historians. The goal of Profit Advisor is to provide measurable profitability improvements safely. The key point is measurable.

“Historically in the process industry we focus on efficiency,” said Chris Lydon, senior vice president of portfolio and strategy at Schneider Electric. “Real time optimization, advanced process control and reliability-centered maintenance are key considerations for process, and they are all efficiency based. It is essential but also insufficient in this day and age. The speed at which business is changing creates opportunities for increased profitability. It is time to focus on how to make clients profitable with the technology we have.”

Using existing technology like Modicon controllers, Avantis enterprise asset management, and Triconex safety systems as a foundation for real time process, reliability and safety control, Schneider Electric is connecting intelligent edge assets to the cloud and joining it with real-time accounting linked to the historian level. This “roll-up accounting” (vs. top down accounting from enterprise resource planning software) takes into account energy costs—which may change every 15 minutes—as well as visibility down to the equipment level.

“It took me a long time to figure out that you can’t develop a generic real-time accounting model in the industrial world,” said Peter Martin, Schneider’s vice president of business and innovation marketing.

Profit Adviser uses three different modes of operation: historical data review and analysis, real-time performance indication, and profit planning. In addition, Seeq analytics and industry-specific plug-ins customize the experience.

Martin says customers can expect a 100 percent ROI within three months. “But that’s not the power of the tool,” he said. “It enables effective business diagnostics on process constraints. You may see that the real issue is a pump and no one wants to switch that pump out. Suddenly we have data to do things we need to do correctly.”

It is repeatable and scalable and can provide ROI on anything done in the plant that is measurable and visible, which empowers the workforce, Martin said.

For its part, Honeywell UOP has taken its Connected Performance Services a step further with the concept of the Honeywell Connected Plant, which the company describes as an entry point into Industry 4.0 and the Industrial Internet of Things (IIoT). It connects the process (including refining and petrochemical domain expertise of Honeywell UOP) with operators to give them greater visibility into assets. And, much like the Schneider Electric message, the goal is to create a more profitable plant.

“It is all about how to drive increased profitability for the customer,” said Paul Bonner, vice president of consulting and data analytics for Honeywell Connected Plant. “Increasing throughput for the plant, increasing the yield and reducing the cost and risk for the user.”

The offering brings together technology from three different Honeywell businesses to couple predictive analytics with process and equipment KPIs in order to understand key constraints. Data from devices is captured and organized in a way that it can be connected to the business to apply analytics. In addition, Honeywell’s cloud infrastructure, called Sentience, together with Honeywell data scientists and partners from the Honeywell INspire program are working on offering new configurable apps that customers can use.

“We are solving unplanned downtime, underperforming assets and human capital challenges,” Bonner said.

Leaders relevant to this article: