It might surprise people to know that North America is the largest market for Swiss automation and power giant ABB. With its acquisition of GE Industrial Solutions announced this week, ABB not only furthers its market depth in North America, but positions itself to lead the electrification market in the U.S.

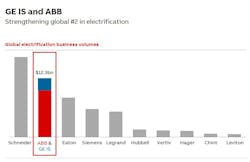

ABB CEO Ulrich Spiesshofer has repeatedly made the point that ABB is No. 1 or 2 in all of its four major businesses: electrification, robotics and motion, industrial automation and power grids. Globally, ABB is No. 2 in electrification behind Schneider Electric. This acquisition strengthens that position, and puts it in a better position to continue to push for the No. 1 slot.

At ABB Customer World earlier this year in Houston, Spiesshofer emphasized his company’s involvement in the U.S. market, including being the first global player to produce robots locally to sell in the U.S. “ABB has been active in the U.S. for more than 100 years, and we’ve invested more than $10 billion in the last seven years,” he said. “We have 20,000 employees in 60 manufacturing sites just in the U.S.”

Worth about $30 billion, the U.S. is the world’s largest electrification market, according to Spiesshofer. GE Industrial Solutions, headquartered in Atlanta, has a strong installed base and roots in North America, with revenues of about $2.7 billion globally in 2016.

ABB will acquire GE Industrial Solutions for $2.6 billion. The transaction will be operationally accretive in year one, and ABB expects to realize about $200 million of annual cost synergies in year five, which will be key to bringing GE Industrial Solutions to peer performance.

ABB is looking to recapture market share for GE Industrial Solutions and increase profit margins, which were about 8 percent in 2016. “It was not a core business to GE, and they had not invested heavily in it in recent years,” said Doug Schuster, senior vice president and head of the global business unit Installation Products. “But we also see opportunities where there’s some synergy. We can get in and support that.”

GE Industrial Solutions will be integrated into ABB’s Electrification Products (EP) division, which will have an initial dampening effect on EP’s profit margins. ABB, however, is committed to returning EP to its target margin corridor of 15-19 percent during 2020.

“We look forward to working with GE Industrial Solutions’ and ABB’s customers and channel partners to create new opportunities in this highly attractive core market for our division,” said Tarak Mehta, president of ABB’s EP division. “We have a clear integration plan to realize the synergies of this combination and to bring our combined business back into the target margin corridor during 2020.”

Despite the lack of investment from GE in recent years, when ABB was doing its evaluation of GE Industrial Solutions it saw “really strong nuggets of gold that made this an opportunity for us,” Schuster said, mentioning some of its product engineered solution set, digital platform, customer relationships and the strength of its brand.

ABB’s EP division offers a comprehensive portfolio of low- and medium-voltage products for a smarter, more reliable flow of electricity from substation to socket. The acquisition of GE Industrial Solutions adds low- and medium-voltage protection and control, building products and critical power supply to the mix.

“What this does for the Electrification Products business,” Schuster said, “is it really adds tremendous new market access for combining a product portfolio that ABB has with the portfolio that GE has, and puts us in a significant new position. The strategy behind this deal was gaining more market access in North America.” ABB’s significant global presence also adds access for GE, Schuster added.

Broader acquisition strategy

“With this next step of active portfolio management, we continue to shift ABB’s center of gravity, in line with our Next Level strategy, by strengthening competitiveness, mainly in the North American market, and lowering risk with an early-cycle business,” Spiesshofer said.

The billions of dollars that ABB has invested in the U.S. market has included its acquisitions of Baldor in 2011 and Thomas & Betts in 2012, plus new factories for robotics, said Schuster, who came to ABB as part of the Thomas & Betts deal. “For us, adding GE Industrial Solutions was a very logical next step.” Power One, acquired in 2013, is also part of the EP group.

A significant investment that ABB made more recently outside the U.S. was its acquisition this year of B&R, a major player in machine and factory automation—a deal that Spiesshofer called probably the most important deal that ABB has done, strategically.

Though Schuster couldn’t speak to any specific acquisition plans for the future, more are likely as the supplier continues to see which areas need strengthening. “ABB is very thoughtful and strategic about the business and portfolio, and we will always be looking for those opportunities,” he said. Once the GE Industrial Solutions acquisition is complete, the teams will evaluate both portfolios effectively and thoroughly, and see if it makes sense to fill any gaps, he added.

Included in the latest acquisition is a long-term right to use the GE brand. ABB will retain the GE Industrial Solutions management team and build on its experienced sales force.

As part of the transaction and overall value creation, ABB and GE have agreed to establish a long-term strategic supply relationship for GE Industrial Solutions products and ABB products that GE sources today.

ABB was looking to take advantage of GE Industrial Solutions’ current status as a supplier to other groups within GE, Schuster explained. “We want to make sure we keep that relationship strong after the deal closes,” he said. “There are also newer opportunities for ABB and the rest of GE to work together, especially utility facilities, wind farms and other projects where we can add value.”

There is also significant opportunity to further develop smarter, cloud-connected products, which ABB operates under its ABB Ability umbrella, Schuster said.

“We’ve spent a lot of time talking with customers and our distributor and channel partners, and this was viewed as the deal that should happen,” Schuster said. “It really encourages us and excites us about this opportunity even more.”

The sale of Industrial Solutions is GE’s first big portfolio shift since John Flannery took over as CEO of the company almost two months ago, and we will likely hear more around or soon after GE’s Minds + Machines conference in late October about GE’s other portfolio plans.

“ABB values our people, domain expertise, and our ability to operate in the segments where we have depth and experience,” Flannery said. “GE will also benefit through an expanded strategic supply relationship with ABB as the two companies work together.”

The transaction is expected to close in the first half of 2018, subject to customary regulatory clearances.

Leaders relevant to this article: